For the last couple of days I have been involved in lively discussions with friends about how non profits organizations keep their books. The hottest area of discussion was how to properly account for unrestricted and restricted revenues and expenses. And the journal entries that need to be booked when restricted revenue is released from restriction. During the discussions, I realized that it very easy to assume that as long as you know how the for-profits accounting is performed then you would not have issues replicating that knowledge to a non -profit entity. Well, this is true however, it is worthwhile noting that there are key differences that are note worthy and necessary to highlight in this blog posting. To this end this blog posting will explain in detail the basics of accounting for non Profits and specifically the following:

I. Background information for accounting for Non Profits

II. Fund accounting as used in the Non Profits world

III. Non Profits Inter Fund Accounts

IV. Net assets released from restrictions

V. Chart of Accounts

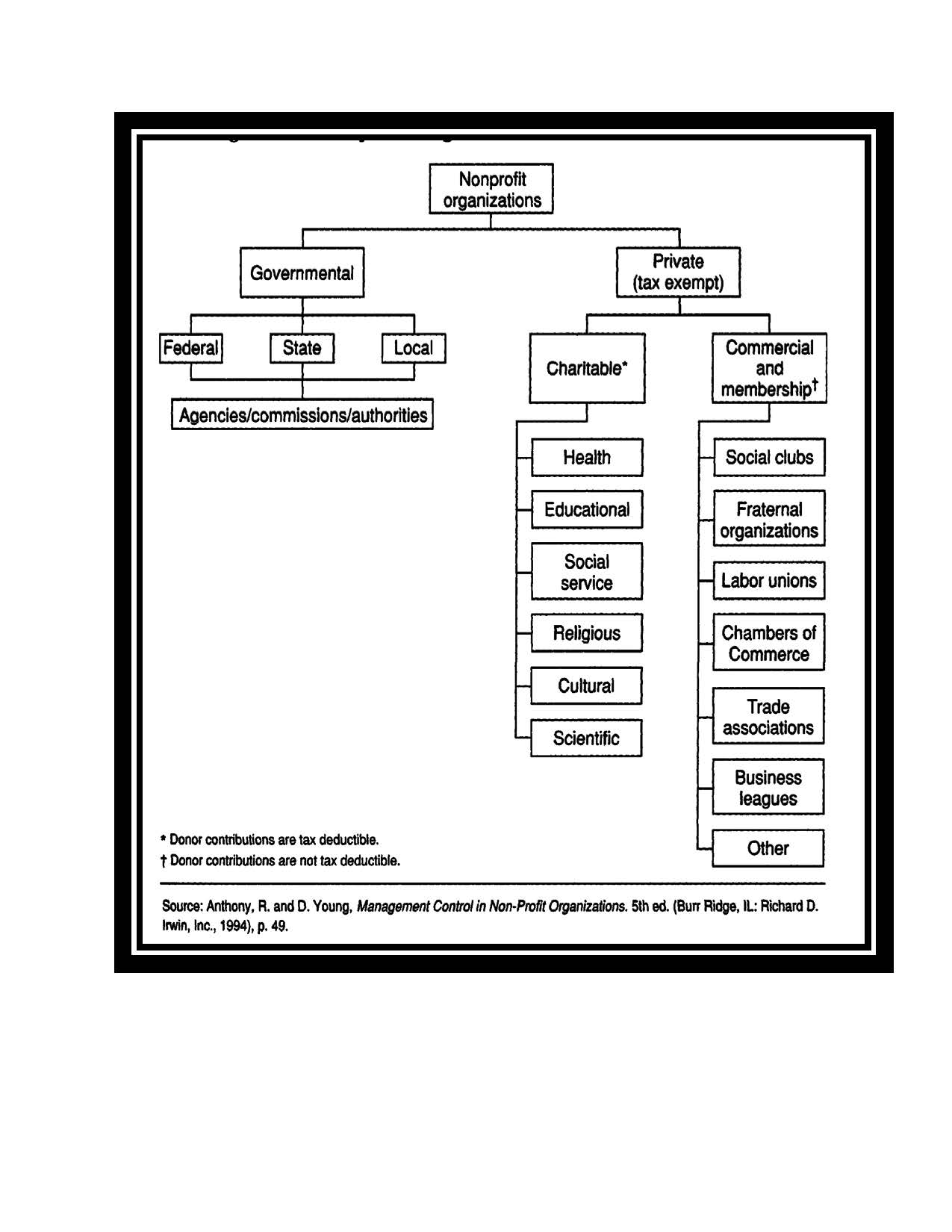

I. Background information for Accounting for Non Profits

Accounting for non profits is very similar to project accounting. Revenues and expenses are tracked at a much more detail than what happens with for profits detailing information such as the source, purpose and where to allocate revenues and expense in terms of various funds. Generally non profits follow what we call fund accounting. Each revenue and expense must be booked in the right fund, the right fund expense, the right revenue fund, the right account and the right department.

When dealing with the for-profit accounting, we have retained earnings however when dealing with the nonprofit accounting, we have funds or net assets. Though the word fund has many meanings, for the purpose of this explanation fund and net assets mean one and the same thing.

The main purpose of fund accounting is to show flow of resources and how the resources have been spend based on certain restrictions such as legal, donor or other requirements. Therefore, to reflect this level of detail accounts are set up to account for the type of revenue or expense, type of fund, and type of grantor, department etc. Due to this level of detail, many nonprofit organizations accounts have several digits to identify general ledgers accounts, departments, grants, funds etc. Therefore, in this regard, it is not uncommon to have eight digits in the accounting code such as, 6700.22.986.004. The first four digits identify an expense account, the“22” is a department, 986” is a funding source and “004” identifies the fund. At the end of the year, revenues and expenses are closed to the fund they belong.

II. Fund accounting as used in the Non Profits world

There are three main types of funds:

- General fund-Unrestricted net assets

- Restricted fund-Temporarily restricted net assets

- Permanently restricted fund-Permanently restricted net assets

As mentioned previously, the purpose of creation of funds is to segregate resources, which could be limited by law or donors. I feel obligated to repeat this emphasis several times because this is the key to clearly understanding the non profits accounting. SFAS 117 provides the rules of what is booked in each fund. For more details about what to book in each of the three categories of funds go to Statement of Financial Accounting Standard # 117

Again I repeat that funds/net assets are not assets. Think of them as projects with their own set of financial statements. At the end of the year when the books are closed, revenue and expenses are closed in different funds similar to a set of different books for different companies.

Below I will go into further detail about how each of the three funds is utilized:

General Fund-Unrestricted Net Assets

This fund contains resources that are not restricted and is used to run day to day operations of the nonprofit. For example if a nonprofit receives $1,000 to be used for current activities. This amount is booked in the unrestricted fund. The journal entry would be a debit to cash and a credit to revenue-contributions-unrestricted.

Most expenses are recorded in this fund despite the fact that revenues are booked in other funds. For example, an organization gets $50,000 donation for scholarships for needy students. The entries to book this donation are debit to cash and credit to temporarily restricted account- scholarships revenue account. After the $50,000 is spent, then a credit is made to

cash, and a debit is made to Scholarship account expense- unrestricted in the general fund. Sometimes some non profits create inter fund receivable and a payable which I will discuss in more details later in this blog posting. But for now let’s assume these inter fund accounts are not set up and the following entries are booked directly. So the other journal entry is debit the “Net Assets Released from Restriction” to decrease the temporarily restricted fund, and to credit the general fund, actually to reduce the Scholarship account expense account previously debited to pay the expense. The result is that expenses are shown in the unrestricted fund, but are credited with a journal entry.

Restricted Fund-Temporarily Restricted Net Assets

This is fund is used to account for moneys to be used for a specific purpose, as per donor or legal restrictions. But bear in mind that there is no need to have to open a fund for each type of donation and at the same time, there is no need lose track of restricted funds.

Permanently Restricted Fund-Permanently Restricted Net Assets

Permanently restricted fund is also popularly known as “endowment fund.” In most cases the organization uses investment income and leaves the principal intact.

III. Non Profits Inter-Fund Accounts

Inter-fund accounts are accounts that connect all funds. At year end, these accounts are eliminated during consolidation. Let me give an example to make this explanation more clear. Assume the general fund needs to borrow from restricted funds to meet current expenditures. This creates a liability in the general fund and a receivable in restricted fund. Therefore, for record keeping purposes, “due to/due from” accounts is used to track inter fund receivable and payable.

IV. Net assets released from restrictions

This account is normally used between the unrestricted and temporarily restricted funds and is shown as line item in the revenue area of financial statements. For example, assume organization A pays $5000 for Scholarships. Further, assume that scholarship donations are kept in a restricted fund. At the time of payment cash for the expense comes out of the general fund checking account. The journal entries would be:

1. JE-100- General Fund-Scholarship expense $5000 DR

General Fund -Cash $5,000 CR

2. JE-200-General Fund- Inter-fund receivable $5,000 DR

Restricted Fund- Inter-fund payable $5,000 CR

3. JE-300 Restricted Fund-Net assets released from restriction 5000 DR

General Fund-Net assets released from restriction $5,000 CR

Explanation of the journal entries:

- The first journal entry records the transaction in the General Fund through the Accounts Payable module at the time a check is processed.

- The second journal entry records the inter-fund receivable and payable because the money for this expense is deposited in the restricted fund cash account and needs to be transferred out of the general fund cash account. Eventually, when cash is transferred from one banking account to another, this entry is reversed. Management can make a policy that cash transfers occurs monthly , quarterly or on other regular basis based on balances on inter-fund accounts or other parameters

- The third and last journal entry recognizes the transaction as restricted. This release from restrictions entry reclassifies the expense from the general fund to the restricted fund.

It is good accounting practice to keep an audit trail of why money is being released. This may be in a separate spreadsheet with details, or even enough description in the journal entries may be adequate.

V. Chart of Accounts

The chart of accounts drives everything in accounting and supports accurate preparation of financial statements and other management reports. Chart of accounts should be set carefully to ensure that it is able to accommodate many funds, inter-fund receivables/payables, special financial, grant and 990 mandated reporting. Most of the nonprofit organizations set up their chart of accounts following the line items in the 990, and this is usually good practice.