For those who play one of the many roles of Non profits affairs as a donor, member, customer, supplier, supporter, student etc the presentation of the financial statements can sometimes be challenging. We have seen different forms of presentation of these financial statements and sometimes wonder why they are so different and yet they relate to non profits financial information presentation anyway. As you will realize in this presentation, there are different recommended formats of presentation of financial statements for Non Profits. Therefore, in this article, I will explain the different financial statements presentation formats and the appropriateness of use.

As with any business, Non Profit organizations need up-to-date, reliable, and meaningful financial data to gauge operating position and financial status. Financial information should be accumulated, summarized, recorded, processed, reviewed and reported. The accounting records must be accurate. Internal controls must exist to ensure accurate financial reporting, compliance with laws and regulations and protection of assets.

ASC 958-205-05-5, Not for-Profit Entities: Presentation of Financial Statements (FAS-117, Financial Statements of Not-for-Profit Organizations), promulgates standards for external financial statements reporting. The standard requires the following basic financial statements:

- The statement of activities,

- The statement of financial position

- The statement of cash flows and

- The accompanying notes

With this new standard it is noteworthy that presenting financial information by fund is no longer a requirement. However, Non profits may continue reporting using fund accounting for internal purposes only.

Below I will explain some basic details about the three types of financial statements listed above:

Statement of Financial Position (Balance Sheet)

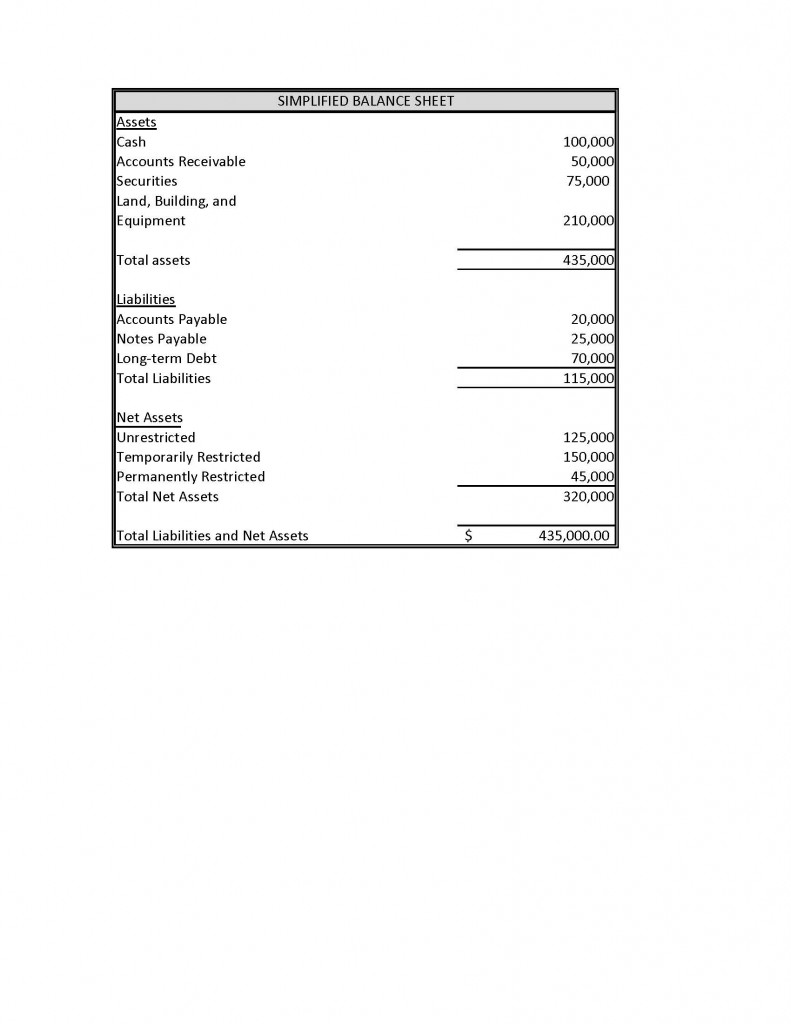

In accordance with ASC 958-205-05-5, Not-for-Profit Entities: Presentation of Financial Statements (FAS-117), the Statement of Financial Position (Balance Sheet) should present assets based on nearness to cash and sequencing of liabilities according to nearness of maturities. The other acceptable option is that Non Profits may present a classified Statement of Financial Position showing assets and liabilities as current and noncurrent.

Also, it is a requirement that the statement of financial position (balance sheet) presents the total of unrestricted funds and the total of restricted funds.

In the next post I will show an example of a detailed statement of financial position which is one of the acceptable formats of presentation. However, in the meantime I will present below a simplified presentation of financial position which is also another form of the acceptable forms of presentation of the statement of financial position.

Pretty nice post. I just stumbled upon your blog and wished to say that I have really enjoyed browsing26 your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!…

My blog is on Fitness programs.